A Variable Annuity Has Which of the Following Characteristics

D an accounting measure used to determine payments to the owner of the variable annuity. During this lesson we will review the characteristics.

Solved Which Of The Following Is Characteristic Of Variable Chegg Com

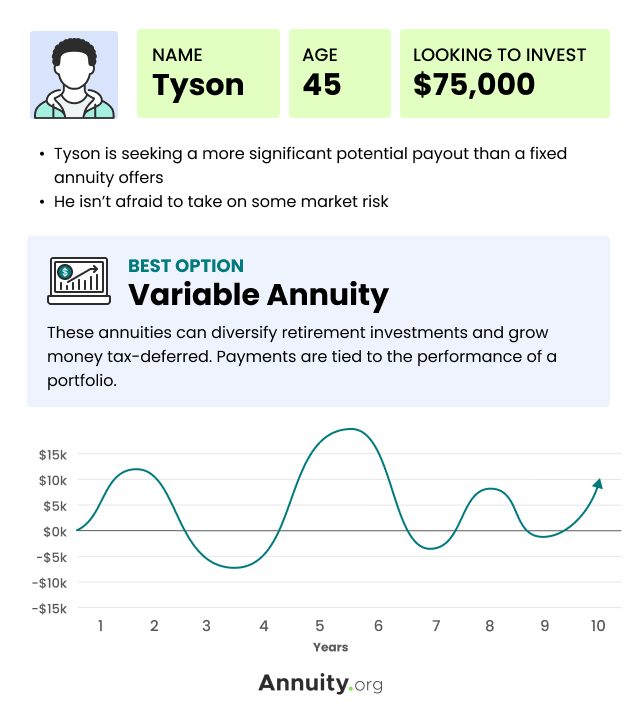

A fixed annuity might be a better option for a more conservative investor.

. Minimum Death benefit is guaranteed. In general variable annuities have two phases. The variable annuitys value is based on the performance of underlying investment portfolios.

Policy owner selects where savings reserve is invested. A Variable Annuity has which of the following characteristics. Bond fund and 50 5000 to a stock fund.

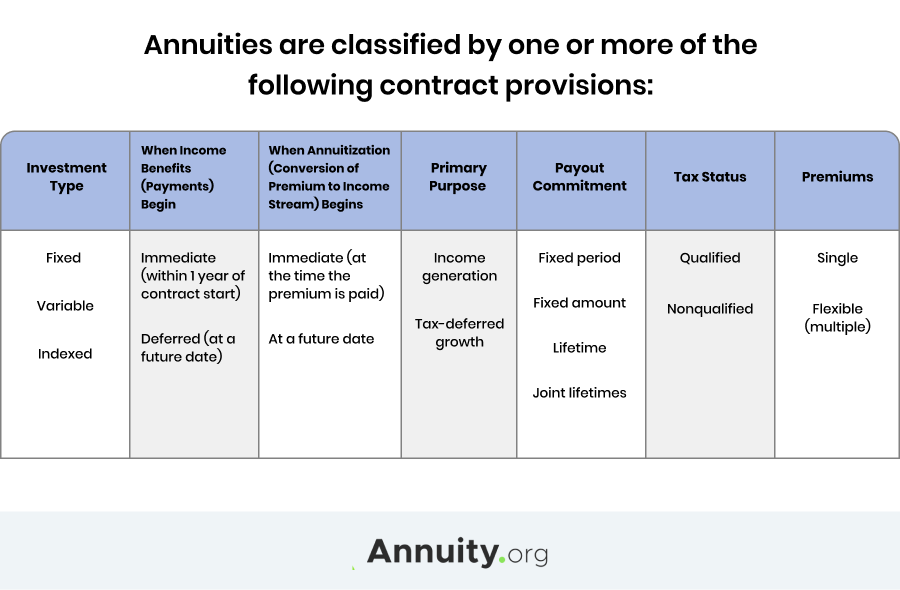

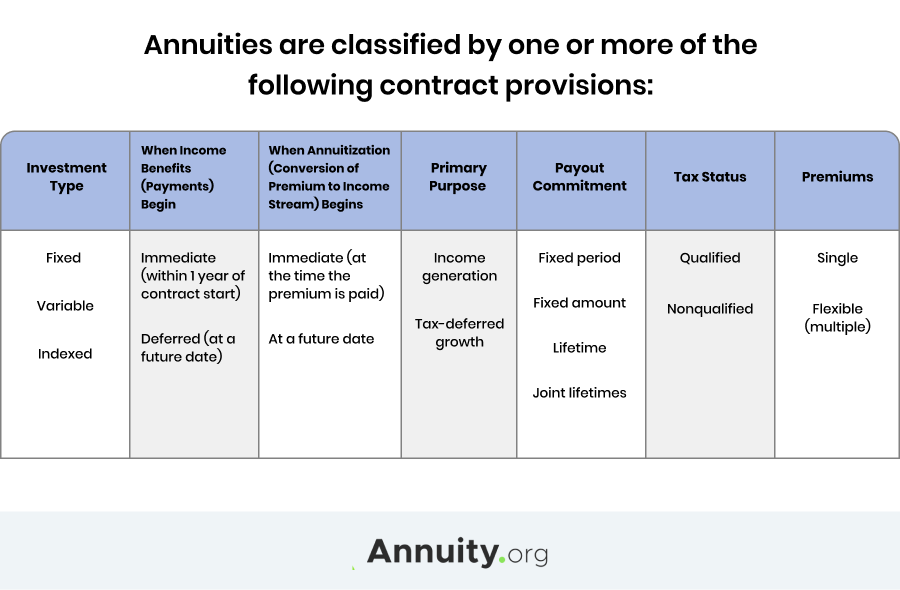

A the safety of the principal invested B the yield is always higher than bond yields. Deferred variable annuities originated in the US. Here we compare fixed vs.

Variable Rate of Return Sub-accounts with multiple investment options within the portfolio Tax-deferred Growth No Maximum Contributions. A variable annuity is different from a fixed annuity in that it does not guarantee an interest yield from investments. The principal is the amount the policyholder pays into the annuity.

A deferred annuity can be converted to an immediate annuity or a lump sum of money from another source can be used to purchase an immediate annuity. What are the characteristics of fixed annuities. Key Facts of a Deferred Variable Annuity.

Your client has a large sum of money to invest from the proceeds of the sale of his home. The principal and the return. A variable annuity is a type of annuity contract the value of which can vary based on the performance of an underlying portfolio of sub accounts.

At the end of the year your account has a value of 10750. The creation of an estate. With variable annuities policyholders can choose from a number of investment opportunities.

They have all the same characteristics as life insurance. There are no surrender fees. All of the following are characteristics of variable life insurance EXCEPT.

After a deferral period variable annuities may produce more income. Guaranteed income starting immediately. The amount of the purchase payments that go into the account may be less than you paid because fees were taken out of the purchase payments.

Fixed annuities are one of the major annuity options offered by insurance companies. They can be purchased in periodic systematic or lump sum payments. Deferral in variable annuities allows the value of the annuity to increase over time.

1 the accumulation phase when the premiums you pay are allocated among investment portfolios or subaccounts and your earnings on these investments accumulate. However some variable annuities also offer a fixed-rate account which is guaranteed by the issuing insurance company. Common traits of Variable Annuities.

Having guaranteed income from an annuity can give investors the confidence to invest more assertively with other assets. Approximately 60 years ago. And 2 the distribution phase when the insurance company guarantees a minimum payment to you based on the principle and investment returns.

A variable annuity has two phases. Income Annuity Quotes From Top-Rated Insurers. An immediate annuity pays a regular income usually monthly to the annuitant.

You purchase a variable annuity with an initial purchase payment of 10000. A variable annuity is an investment product that allows a sum of money to grow on a tax deferred basis. All of the following are characteristics of Variable Annuity contracts EXCEPT.

The return is the income the policyholder makes through their investment selection. All of the following are true about annuities EXCEPT. B an accounting measure used to determine the contract owners interest in the separate account.

Ad Compare income annuity quotes from across the market quickly and for free. A fixed in value until the holder retires. Underlying equity investments T age 70 withdraws cash from a profit-sharing plan and purchases a Straight Life Annuity.

Providing safety of investment and guaranteed return fixed annuities are favored by people who wish to invest their money but have limited funds and are therefore not willing to take any investment risks. Variable annuities have two components. An Immediate Annuity is designed to provide each of the following features EXCEPT.

An accumulation phase and a payout annuitization phase. An annuity can help you create a stream of guaranteed income for retirement. You allocate 50 of that purchase payment 5000 to a.

The possibility of higher returns and greater income than fixed annuities but theres also a risk that the account will fall in value. Cash value is not guaranteed. An accumulation unit in a variable annuity contract is.

During the accumulation phase you make purchase payments. C none of these. Sub accounts and mutual funds are conceptually identical but sub accounts dont have ticker symbols that investors can easily type into a fund tracker for research purposes.

Over the following year the stock fund has a 10 return and the bond fund has a 5 return. A variable annuity is a type of annuity contract that pairs the growth potential of the stock market with the steady retirement income. Bianca has FINRA Series 7 63 SIE licenses and has licensing program at her firm for 5 years.

An important basic characteristic of common stocks that makes them a suitable type of investment for the separate account of variable annuities is. At retirement the balance is annuitized or begins to pay out regular payments as income. Ad Learn More about How Annuities Work from Fidelity.

Variable Annuity What Are Variable Annuities How Do They Work

Annuity Vs Life Insurance Similar Contracts Different Goals

Solved Question 28 Annuities Have Many Features And Characteristics Which Of The Following Statements Is Correct The Initial Rate On A Fixed Annu Course Hero

How To Compare Different Types Of Annuities Annuity Comparison

No comments for "A Variable Annuity Has Which of the Following Characteristics"

Post a Comment